Navigating The Stock Market In 2025: Understanding Columbus Day And Other Market Holidays

Navigating the Stock Market in 2025: Understanding Columbus Day and Other Market Holidays

Related Articles: Navigating the Stock Market in 2025: Understanding Columbus Day and Other Market Holidays

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Stock Market in 2025: Understanding Columbus Day and Other Market Holidays. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Stock Market in 2025: Understanding Columbus Day and Other Market Holidays

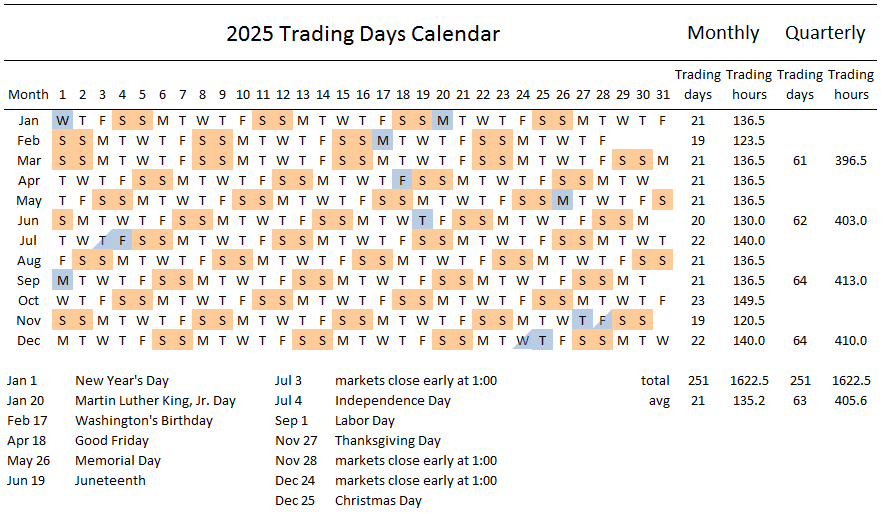

The stock market, a complex ecosystem of buying and selling securities, operates on a schedule that is influenced by a variety of factors, including holidays. While the market generally functions during regular business hours, certain days are designated as holidays, leading to temporary closures. Understanding these closures, their impact on trading, and the implications for investors is crucial for navigating the market effectively.

Columbus Day 2025: A Market Closure

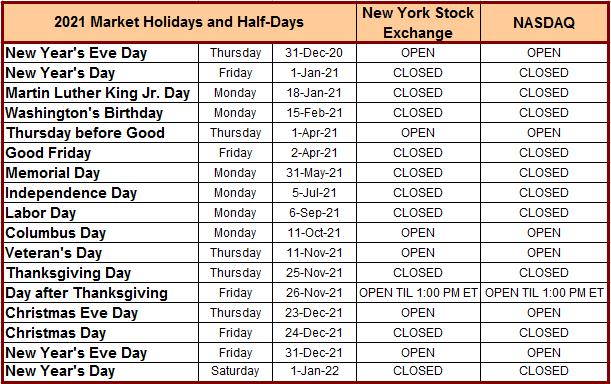

Columbus Day, celebrated on the second Monday of October, is a federal holiday in the United States. While many businesses and government offices observe this holiday, the New York Stock Exchange (NYSE) and the Nasdaq Stock Market, the two major exchanges in the US, remain closed on this day. This closure signifies a halt in regular trading activities, affecting both individual investors and institutional traders.

The Significance of Market Holidays

Market holidays, like Columbus Day, serve several purposes:

- Observing Cultural Significance: Holidays provide an opportunity to acknowledge cultural and historical events, fostering a sense of national unity and shared identity.

- Employee Well-being: By providing employees with time off, these holidays promote work-life balance and enhance overall employee well-being.

- Market Stability: Closures allow market participants to take a break, preventing potential volatility and ensuring a more stable trading environment.

Impact of Market Closures on Investors

The closure of the stock market on holidays like Columbus Day has several implications for investors:

- Trading Halt: No trading occurs on the NYSE and Nasdaq, preventing investors from buying or selling securities during this period.

- Price Fluctuations: Market movements during the closure are not reflected in real-time prices, potentially leading to price discrepancies when the market reopens.

- Delayed Information: News and events occurring during the holiday can influence market sentiment, but investors lack access to real-time information and cannot react immediately.

Navigating Market Holidays: Tips for Investors

Investors can effectively navigate market holidays by following these tips:

- Plan Ahead: Anticipate the holiday closures and adjust trading strategies accordingly.

- Stay Informed: Monitor news and events that may impact the market even during closures.

- Consider Alternative Investments: Explore opportunities in markets that remain open during the holiday, such as foreign exchange or commodities.

- Review Portfolio: Use the time to analyze your portfolio, rebalance holdings, and make informed investment decisions.

Frequently Asked Questions (FAQs) About Market Holidays

Q: What happens to my orders placed before a market holiday?

A: Orders placed before a market holiday are typically executed on the next trading day when the market reopens. However, it is important to consult with your broker for specific details on order execution during holidays.

Q: Can I still access my brokerage account during a market holiday?

A: While trading is halted, you may still be able to access your brokerage account and review your portfolio, depending on the specific platform.

Q: How do market holidays affect options trading?

A: Options trading is also halted on market holidays. However, options contracts may still expire during the closure, and their value may be affected by events that occur during the holiday period.

Q: Is it advisable to invest during a market holiday?

A: Generally, it is not recommended to invest during market holidays as trading is halted, and information flow is limited. However, certain investment strategies may be employed during these periods, such as setting up limit orders for execution after the market reopens.

Conclusion

Market holidays, including Columbus Day, play a crucial role in the overall functioning of the stock market. Understanding the implications of these closures, their impact on trading, and the available options for investors is essential for navigating the market effectively. By planning ahead, staying informed, and considering alternative strategies, investors can minimize the impact of market holidays and continue to pursue their investment goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Stock Market in 2025: Understanding Columbus Day and Other Market Holidays. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- Exploring The World In February 2025: A Guide To Travel Destinations

- Navigating The Summer School Holidays In The UK: A Comprehensive Guide For 2025

- Navigating Singapore’s Public Holidays In 2025: A Comprehensive Guide

- A Comprehensive Guide To Skiing Holidays In January 2025

- Embracing The Winter Wonderland: A Comprehensive Guide To Ski Holidays In January 2025

- Tenerife In April 2025: A Springtime Escape To The Canary Islands

- The Future Of Travel: A Look At Holiday Trends For 2025

- Unveiling The World Of Travel: An Exploration Of Thomas Cook’s 2025 Brochure

Leave a Reply