Tech Mahindra: A Look At Future Potential And Key Factors Influencing Share Price

Tech Mahindra: A Look at Future Potential and Key Factors Influencing Share Price

Related Articles: Tech Mahindra: A Look at Future Potential and Key Factors Influencing Share Price

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Tech Mahindra: A Look at Future Potential and Key Factors Influencing Share Price. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Tech Mahindra: A Look at Future Potential and Key Factors Influencing Share Price

Tech Mahindra, a leading global provider of IT services and solutions, has established itself as a prominent player in the technology landscape. As investors navigate the ever-evolving world of stock markets, understanding the potential trajectory of Tech Mahindra’s share price becomes crucial. This article aims to provide a comprehensive analysis of the factors that could influence the company’s performance in the coming years, offering insights into its future prospects.

Understanding the Dynamics of Tech Mahindra’s Share Price

Predicting share price movement is inherently complex, influenced by a multitude of internal and external factors. These include:

1. Industry Trends and Growth: The IT services industry is characterized by rapid technological advancements, shifting customer demands, and fierce competition. Tech Mahindra’s ability to adapt to these trends and capitalize on emerging opportunities will play a significant role in its share price performance.

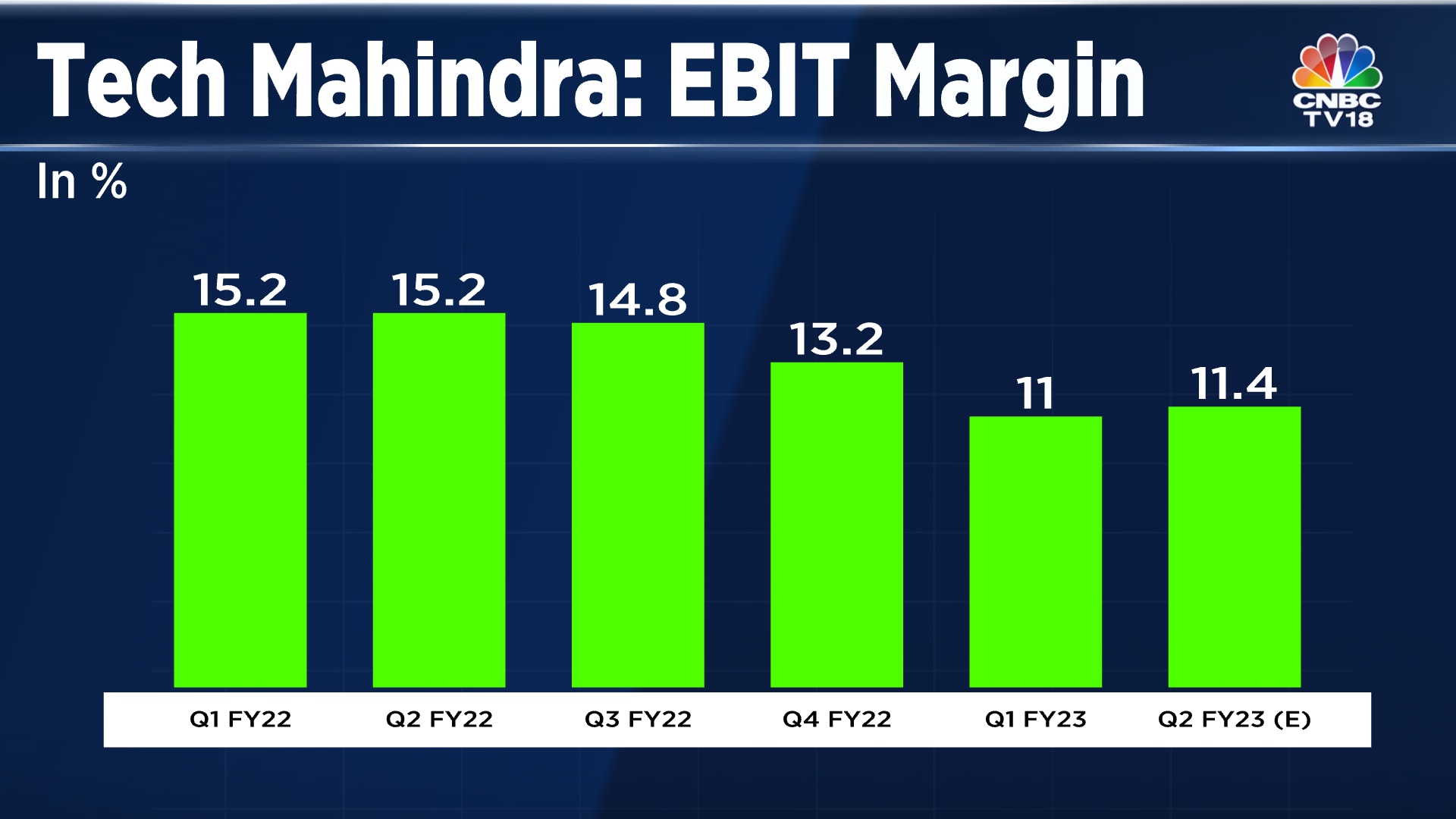

2. Company Performance and Financial Health: Key indicators such as revenue growth, profitability, and debt levels provide insights into the company’s financial health and future prospects. Strong financial performance typically translates into higher investor confidence and potentially increased share prices.

3. Market Sentiment and Investor Confidence: The overall market sentiment and investor confidence in the technology sector can significantly impact individual stock prices. Positive market conditions often lead to increased investment in technology companies, potentially boosting share prices.

4. Global Economic Conditions: Macroeconomic factors such as interest rates, inflation, and global economic growth can influence investor behavior and affect stock market performance. Adverse economic conditions can lead to market volatility and potentially impact share prices.

5. Company Strategies and Initiatives: Tech Mahindra’s strategic focus on areas like digital transformation, cloud computing, and cybersecurity, coupled with its initiatives in mergers and acquisitions, can impact its competitive position and future growth prospects, ultimately influencing its share price.

Key Drivers of Tech Mahindra’s Future Performance

1. Digital Transformation and Cloud Services: The increasing adoption of digital technologies across industries presents a significant opportunity for Tech Mahindra. The company’s expertise in cloud computing, artificial intelligence, and data analytics positions it well to capitalize on this trend.

2. Focus on Emerging Technologies: Tech Mahindra’s investments in emerging technologies like 5G, blockchain, and the Internet of Things (IoT) are expected to contribute to its future growth. These technologies are driving innovation across industries and offer significant potential for revenue generation.

3. Geographic Expansion: Tech Mahindra’s strategy of expanding its global footprint, particularly in regions like North America and Europe, is expected to contribute to its revenue growth. This expansion allows the company to tap into new markets and diversify its customer base.

4. Strong Partnerships and Acquisitions: Tech Mahindra’s strategic partnerships with technology giants and its acquisitions of specialized companies provide access to new technologies, expertise, and markets, bolstering its competitive position.

5. Focus on Sustainability and Corporate Social Responsibility: Tech Mahindra’s commitment to sustainability and social responsibility initiatives enhances its brand image and attracts investors who value ethical business practices. This commitment can foster a positive perception of the company, potentially leading to increased investor confidence and share price growth.

Analyzing Potential Share Price Targets

While predicting future share prices is inherently speculative, analysts often use various methodologies, including fundamental analysis, technical analysis, and market sentiment analysis, to arrive at potential price targets. These targets should be considered as estimates and not guaranteed outcomes.

Fundamental Analysis: This approach focuses on analyzing the company’s financial health, growth prospects, and competitive position. It involves examining key metrics such as revenue growth, profitability, debt levels, and market share.

Technical Analysis: This approach uses historical price data and trading patterns to identify trends and predict future price movements. It involves analyzing charts, indicators, and other technical tools to identify support and resistance levels.

Market Sentiment Analysis: This approach analyzes investor sentiment and market conditions to gauge overall market optimism or pessimism. It involves monitoring news reports, analyst ratings, and investor surveys to understand the prevailing market sentiment towards the company.

Factors that Could Impact Tech Mahindra’s Share Price in 2025

- Global Economic Outlook: The global economic environment in 2025 will play a significant role in determining market sentiment and investor behavior. A robust global economy is likely to favor technology stocks, potentially boosting Tech Mahindra’s share price.

- Technological Advancements: The pace of technological innovation continues to accelerate. Tech Mahindra’s ability to adapt to emerging technologies and develop innovative solutions will be crucial for its future success.

- Competition: The IT services industry is highly competitive. Tech Mahindra’s ability to differentiate itself from competitors through its expertise, innovation, and customer service will be critical for maintaining its market share.

- Regulatory Environment: The regulatory landscape for technology companies is evolving. Tech Mahindra’s ability to navigate regulatory changes and comply with relevant regulations will be important for its long-term growth.

- Talent Acquisition and Retention: The IT industry faces a talent shortage. Tech Mahindra’s ability to attract and retain skilled professionals will be essential for its continued success.

FAQs on Tech Mahindra’s Share Price

1. What are the key factors driving Tech Mahindra’s share price?

Tech Mahindra’s share price is driven by factors such as industry trends, company performance, market sentiment, global economic conditions, and company strategies.

2. How can I assess the potential share price target for Tech Mahindra in 2025?

While predicting future share prices is complex, analysts use fundamental analysis, technical analysis, and market sentiment analysis to arrive at potential targets. These should be viewed as estimates and not guaranteed outcomes.

3. What are the risks associated with investing in Tech Mahindra?

Risks include competition, economic slowdown, regulatory changes, technological disruption, and talent acquisition challenges.

4. What are some tips for investing in Tech Mahindra?

Conduct thorough research, understand the company’s business model, assess its financial health, consider the risks involved, and invest based on your individual risk tolerance and investment goals.

Conclusion

Tech Mahindra’s future prospects are driven by its ability to adapt to industry trends, leverage emerging technologies, expand its global footprint, and maintain its competitive edge. While predicting future share prices is inherently challenging, understanding the key factors influencing the company’s performance and the potential risks involved can provide investors with valuable insights. By staying informed and conducting thorough research, investors can make informed decisions about their investment in Tech Mahindra.

Closure

Thus, we hope this article has provided valuable insights into Tech Mahindra: A Look at Future Potential and Key Factors Influencing Share Price. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- Exploring The World In February 2025: A Guide To Travel Destinations

- Navigating The Summer School Holidays In The UK: A Comprehensive Guide For 2025

- Navigating Singapore’s Public Holidays In 2025: A Comprehensive Guide

- A Comprehensive Guide To Skiing Holidays In January 2025

- Embracing The Winter Wonderland: A Comprehensive Guide To Ski Holidays In January 2025

- Tenerife In April 2025: A Springtime Escape To The Canary Islands

- The Future Of Travel: A Look At Holiday Trends For 2025

- Unveiling The World Of Travel: An Exploration Of Thomas Cook’s 2025 Brochure

Leave a Reply