Tech Mahindra: Navigating The Future Of Technology And Its Impact On Share Price

Tech Mahindra: Navigating the Future of Technology and its Impact on Share Price

Related Articles: Tech Mahindra: Navigating the Future of Technology and its Impact on Share Price

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Tech Mahindra: Navigating the Future of Technology and its Impact on Share Price. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Tech Mahindra: Navigating the Future of Technology and its Impact on Share Price

Predicting stock prices is inherently complex, and pinpointing a specific target for Tech Mahindra’s share price in 2030 is a challenging task. However, by analyzing the company’s current trajectory, industry trends, and potential future catalysts, we can gain valuable insights into the factors that will influence its future performance.

Key Factors Shaping Tech Mahindra’s Future

Several key factors will shape Tech Mahindra’s future trajectory and ultimately influence its share price:

1. Digital Transformation and Cloud Adoption:

The global shift towards digital transformation and cloud adoption is a major tailwind for Tech Mahindra. As businesses continue to invest in these technologies to enhance efficiency, agility, and innovation, Tech Mahindra’s expertise in cloud services, digital engineering, and data analytics will be in high demand. This trend is expected to drive revenue growth and profitability in the years to come.

2. Emerging Technologies and Innovation:

Tech Mahindra’s focus on emerging technologies such as 5G, artificial intelligence, blockchain, and the Internet of Things (IoT) positions it well to capitalize on the growth opportunities presented by these advancements. The company’s investments in research and development, partnerships with leading technology providers, and focus on developing innovative solutions will be crucial for maintaining its competitive edge.

3. Global Expansion and Market Diversification:

Tech Mahindra’s strategic expansion into new markets and diversification across various industry verticals will be key to its growth. The company’s global presence and focus on serving clients across industries such as telecommunications, financial services, healthcare, and manufacturing will provide it with a wider customer base and resilience to economic fluctuations.

4. Talent Acquisition and Development:

The ability to attract and retain top talent is crucial for Tech Mahindra’s success. The company’s focus on building a diverse and skilled workforce, investing in employee training and development, and fostering a culture of innovation will be essential for maintaining its competitive advantage in the global technology landscape.

5. Economic and Geopolitical Factors:

Global economic conditions, geopolitical events, and regulatory changes can have a significant impact on Tech Mahindra’s performance. The company’s ability to navigate these challenges effectively, adapt to evolving market dynamics, and maintain operational efficiency will be critical for sustained growth.

Analyzing the Potential for Share Price Growth

While predicting a specific share price target for 2030 is impossible, considering the factors outlined above, we can identify potential drivers for growth:

- Strong Revenue Growth: Tech Mahindra’s focus on digital transformation, emerging technologies, and global expansion is expected to drive continued revenue growth. As the company captures a larger share of the growing digital services market, its top line is likely to expand at a healthy pace.

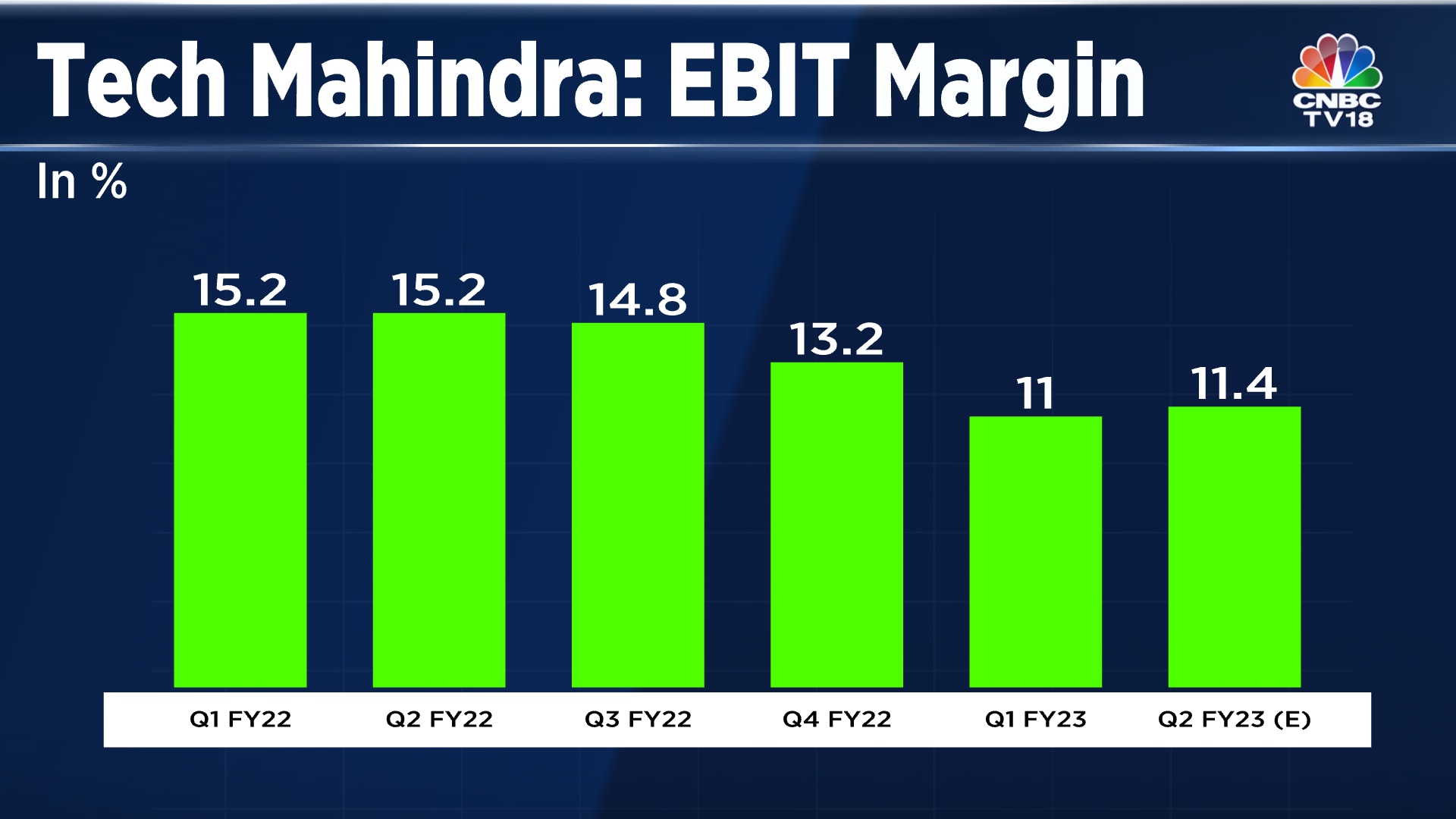

- Improved Profitability: As Tech Mahindra scales its operations and gains efficiency through automation and process optimization, its profitability is likely to improve. This, in turn, can lead to higher earnings per share, which can boost investor confidence and drive share price appreciation.

- Increased Investor Confidence: As Tech Mahindra continues to deliver strong financial performance and demonstrate its ability to capitalize on emerging trends, investor confidence is likely to increase. This could lead to higher demand for the company’s shares, driving up its valuation and share price.

Challenges and Risks to Consider

Despite the positive outlook, several challenges and risks could impact Tech Mahindra’s future performance:

- Intense Competition: The technology services industry is highly competitive, with numerous global players vying for market share. Tech Mahindra faces competition from established giants like Accenture, Infosys, and Wipro, as well as emerging players with specialized expertise.

- Talent Acquisition Challenges: The global demand for skilled technology professionals is high, creating intense competition for talent. Tech Mahindra’s ability to attract and retain qualified employees will be crucial for its future success.

- Technological Disruptions: The rapid pace of technological innovation can create challenges for Tech Mahindra. The company needs to constantly adapt its offerings and invest in research and development to remain at the forefront of technological advancements.

- Economic and Geopolitical Uncertainties: Global economic slowdowns, geopolitical tensions, and regulatory changes can create volatility in the technology services market. Tech Mahindra’s ability to navigate these challenges effectively will be crucial for maintaining its financial stability and growth trajectory.

FAQs

1. What are the key factors influencing Tech Mahindra’s share price in 2030?

The key factors influencing Tech Mahindra’s share price in 2030 include its ability to capitalize on digital transformation, emerging technologies, global expansion, talent acquisition, and its capacity to navigate economic and geopolitical uncertainties.

2. What are the potential drivers for share price growth?

Potential drivers for share price growth include strong revenue growth, improved profitability, and increased investor confidence driven by the company’s performance and market position.

3. What are the challenges and risks facing Tech Mahindra?

Tech Mahindra faces challenges such as intense competition, talent acquisition difficulties, technological disruptions, and economic and geopolitical uncertainties.

4. How can investors assess Tech Mahindra’s future potential?

Investors can assess Tech Mahindra’s future potential by analyzing its financial performance, growth strategies, market position, innovation capabilities, and ability to navigate industry challenges.

5. What are some tips for investors considering Tech Mahindra?

Investors considering Tech Mahindra should conduct thorough research on the company’s financial performance, industry trends, competitive landscape, and potential risks. They should also consider their own investment goals and risk tolerance before making any investment decisions.

Conclusion

Tech Mahindra’s future trajectory will be shaped by its ability to adapt to the evolving technology landscape, capitalize on emerging trends, and navigate economic and geopolitical uncertainties. While predicting a specific share price target for 2030 is impossible, the company’s strong fundamentals, focus on growth, and commitment to innovation suggest a positive outlook for the long term. Investors should carefully consider the factors discussed above, along with their own investment goals and risk tolerance, before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Tech Mahindra: Navigating the Future of Technology and its Impact on Share Price. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- Exploring The World In February 2025: A Guide To Travel Destinations

- Navigating The Summer School Holidays In The UK: A Comprehensive Guide For 2025

- Navigating Singapore’s Public Holidays In 2025: A Comprehensive Guide

- A Comprehensive Guide To Skiing Holidays In January 2025

- Embracing The Winter Wonderland: A Comprehensive Guide To Ski Holidays In January 2025

- Tenerife In April 2025: A Springtime Escape To The Canary Islands

- The Future Of Travel: A Look At Holiday Trends For 2025

- Unveiling The World Of Travel: An Exploration Of Thomas Cook’s 2025 Brochure

Leave a Reply