Tech Mahindra’s Future: A Look At Potential Growth And Valuation In 2025

Tech Mahindra’s Future: A Look at Potential Growth and Valuation in 2025

Related Articles: Tech Mahindra’s Future: A Look at Potential Growth and Valuation in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Tech Mahindra’s Future: A Look at Potential Growth and Valuation in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Tech Mahindra’s Future: A Look at Potential Growth and Valuation in 2025

Tech Mahindra, a leading global provider of digital transformation, consulting, and technology solutions, has consistently demonstrated strong performance and adaptability in the dynamic IT landscape. Understanding its future trajectory, particularly the potential target price in 2025, requires a comprehensive analysis of the company’s strengths, market position, and projected growth drivers.

Analyzing Tech Mahindra’s Strengths and Growth Drivers

Tech Mahindra’s success stems from a combination of factors:

- Strong Industry Expertise: The company possesses deep expertise in various industry verticals, including telecommunications, automotive, financial services, and healthcare. This allows it to provide tailored solutions that address specific client needs.

- Focus on Digital Transformation: Tech Mahindra actively embraces the digital revolution, offering services like cloud computing, artificial intelligence, blockchain, and cybersecurity. This focus aligns perfectly with the growing demand for digital solutions across industries.

- Global Presence and Partnerships: With a global footprint and strategic partnerships, Tech Mahindra enjoys a diverse client base and access to emerging markets. This enables it to capitalize on global growth opportunities.

- Investment in Innovation: The company consistently invests in research and development, fostering innovation and staying ahead of industry trends. This commitment to innovation is crucial for maintaining a competitive edge.

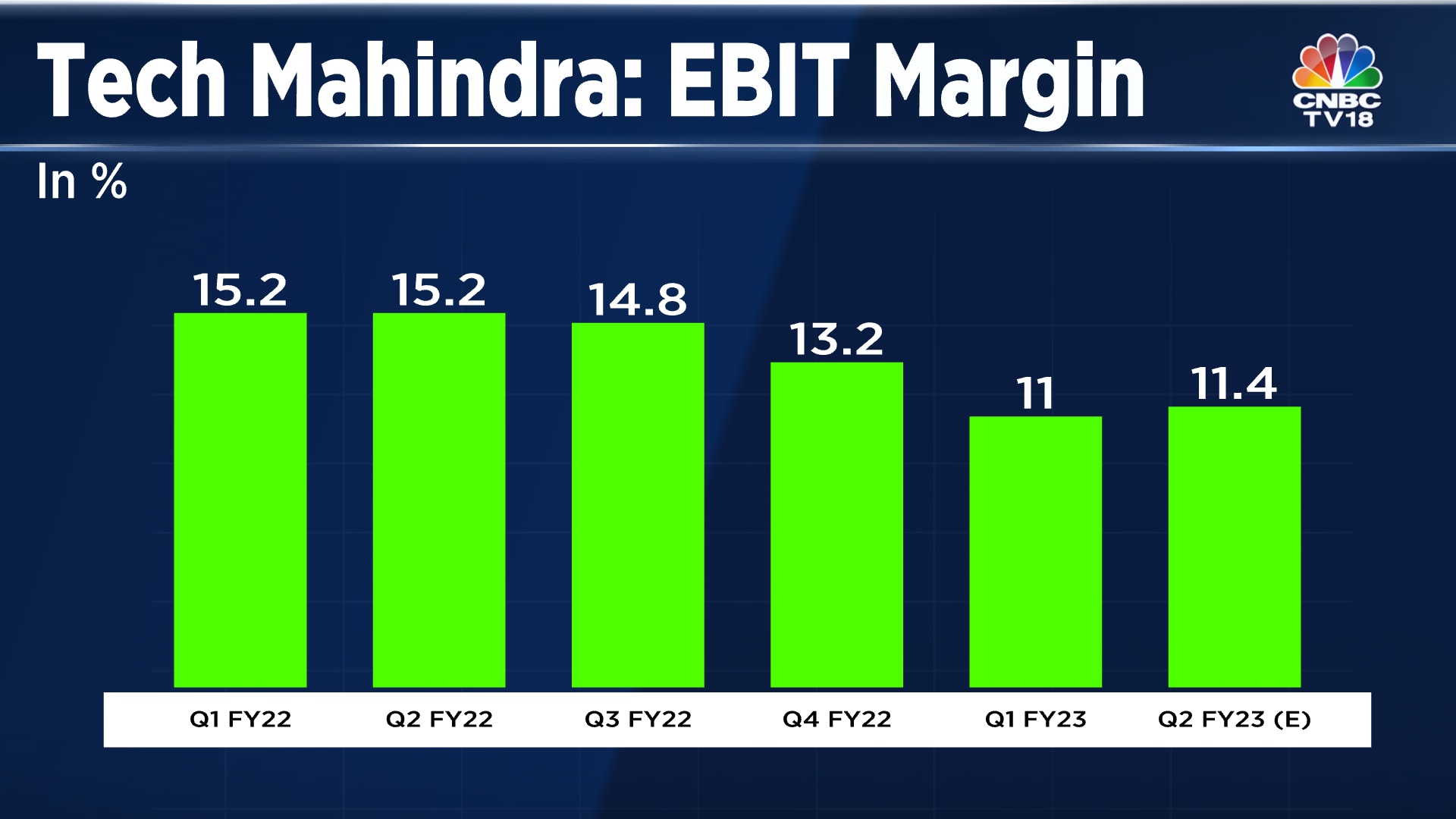

- Strong Financial Performance: Tech Mahindra has consistently delivered strong financial results, characterized by steady revenue growth and profitability. This financial stability provides a solid foundation for future growth.

Market Dynamics and Potential Growth Opportunities

Several factors contribute to the positive outlook for Tech Mahindra’s future:

- Growing Demand for Digital Solutions: The increasing adoption of digital technologies across industries creates significant opportunities for Tech Mahindra. The company’s expertise in digital transformation positions it well to capitalize on this trend.

- Expansion into Emerging Markets: As emerging markets like India and Southeast Asia experience rapid economic growth, Tech Mahindra is well-positioned to leverage its global presence and expertise to capture market share.

- Favorable Regulatory Environment: The Indian government’s focus on digitalization and initiatives like "Digital India" create a favorable regulatory environment for technology companies like Tech Mahindra.

- Consolidation in the IT Sector: The ongoing consolidation within the IT industry presents opportunities for Tech Mahindra to acquire smaller companies and expand its service portfolio.

Evaluating Potential Target Price in 2025

Predicting a specific target price for 2025 is inherently complex and depends on several factors, including:

- Overall Economic Conditions: Global economic growth, interest rates, and inflation all impact the IT sector and influence stock valuations.

- Competitive Landscape: The competitive intensity within the IT industry affects Tech Mahindra’s market share and pricing power.

- Technological Advancements: The rapid pace of technological innovation can create both opportunities and challenges for Tech Mahindra.

- Investor Sentiment: The overall sentiment towards the IT sector and Tech Mahindra’s stock performance influences investor demand and price fluctuations.

Analyzing Analyst Estimates and Market Opinions

Several financial analysts and investment firms have published their forecasts for Tech Mahindra’s target price in 2025. These estimates often vary based on their individual assumptions and methodologies. It’s crucial to consider a range of perspectives and understand the rationale behind each forecast.

Key Considerations for Investors

- Financial Performance: Analyze Tech Mahindra’s financial statements, including revenue growth, profitability, and cash flow, to assess its financial health and future prospects.

- Management Team: Evaluate the experience, expertise, and track record of the company’s management team.

- Competitive Advantage: Understand Tech Mahindra’s competitive advantages and how it differentiates itself from its rivals.

- Risk Factors: Identify potential risks that could impact Tech Mahindra’s future performance, such as economic downturns, technological disruptions, and regulatory changes.

FAQs

1. What factors are likely to drive Tech Mahindra’s stock price in the next few years?

The stock price will be influenced by factors like revenue growth, profitability, expansion into new markets, and the adoption of new technologies.

2. How does Tech Mahindra’s focus on digital transformation impact its valuation?

The growing demand for digital solutions creates significant opportunities for Tech Mahindra, potentially leading to increased revenue and profitability, which could positively impact its valuation.

3. What are the potential risks associated with investing in Tech Mahindra?

Risks include economic downturns, intense competition, rapid technological changes, and regulatory uncertainty.

4. How does Tech Mahindra’s global presence and partnerships influence its future prospects?

A global presence allows Tech Mahindra to access diverse markets and leverage partnerships to expand its reach and service offerings, potentially contributing to future growth.

5. What are the key metrics to monitor when evaluating Tech Mahindra’s performance?

Key metrics include revenue growth, profit margins, cash flow, return on equity, and debt-to-equity ratio.

Tips for Investors

- Conduct thorough research: Before investing, conduct thorough research on Tech Mahindra’s business model, financial performance, and future prospects.

- Consider a diversified portfolio: Diversify your investment portfolio to mitigate risk and reduce exposure to any single company.

- Monitor company developments: Stay informed about Tech Mahindra’s announcements, industry trends, and any potential risks that could impact its performance.

- Seek professional advice: Consult with a financial advisor to get personalized investment advice tailored to your financial goals and risk tolerance.

Conclusion

Tech Mahindra’s strong industry expertise, focus on digital transformation, global presence, and commitment to innovation position it favorably for continued growth in the coming years. While predicting a precise target price for 2025 is challenging, a comprehensive analysis of the company’s strengths, market opportunities, and potential risks can help investors make informed decisions. Ultimately, investors should conduct thorough research, consider a range of perspectives, and monitor key metrics to assess Tech Mahindra’s future prospects and make informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Tech Mahindra’s Future: A Look at Potential Growth and Valuation in 2025. We thank you for taking the time to read this article. See you in our next article!

You may also like

Recent Posts

- Exploring The World In February 2025: A Guide To Travel Destinations

- Navigating The Summer School Holidays In The UK: A Comprehensive Guide For 2025

- Navigating Singapore’s Public Holidays In 2025: A Comprehensive Guide

- A Comprehensive Guide To Skiing Holidays In January 2025

- Embracing The Winter Wonderland: A Comprehensive Guide To Ski Holidays In January 2025

- Tenerife In April 2025: A Springtime Escape To The Canary Islands

- The Future Of Travel: A Look At Holiday Trends For 2025

- Unveiling The World Of Travel: An Exploration Of Thomas Cook’s 2025 Brochure

Leave a Reply